Scottsdale Real Estate Trends 2025 | Market Update & Outlook

Overview of Market Activity

Scottsdale’s residential real estate market in 2025 has been defined by tight inventory, steady buyer demand, and resilient pricing. From January through October, the data reveals a market operating as a mild seller’s environment, with constrained supply but consistent buyer follow-through.

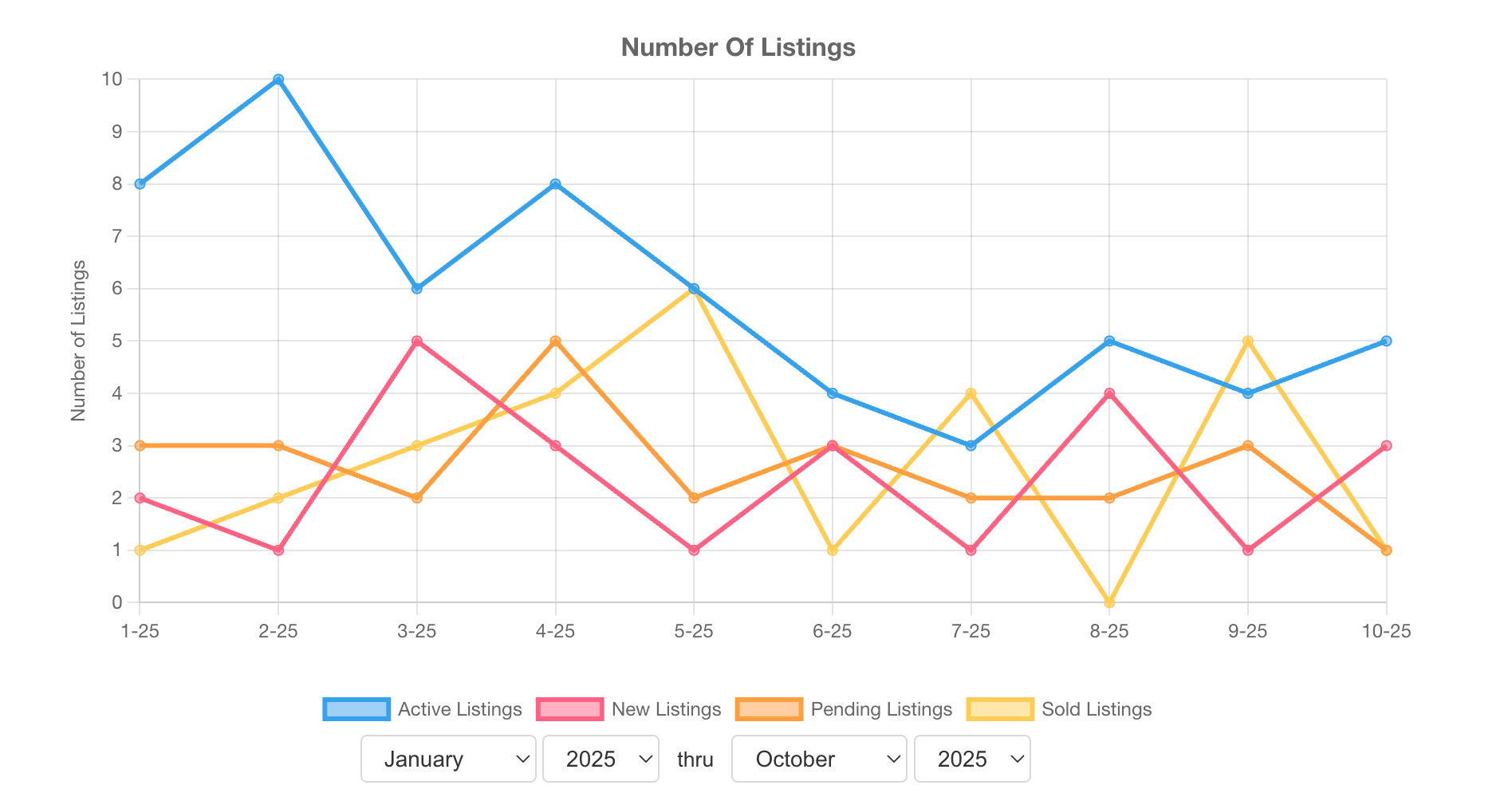

The chart below highlights the year’s listing dynamics - including Active, New, Pending, and Sold listings - demonstrating how Scottsdale’s supply-and-demand balance has shifted throughout 2025.

Market Analysis Summary

Scottsdale’s 2025 market reflects tight supply and steady demand:

Inventory compression: Down roughly 40% from February highs.

Seller caution: Few new listings entering the market.

Buyer persistence: Transactions continue at a measured but steady pace.

Result: A mild seller’s market - prices are supported, days on market are likely short, and competition remains moderate for well-priced homes.

Regional 5-Year Price Forecast: Phoenix–Mesa–Chandler Metro

Context

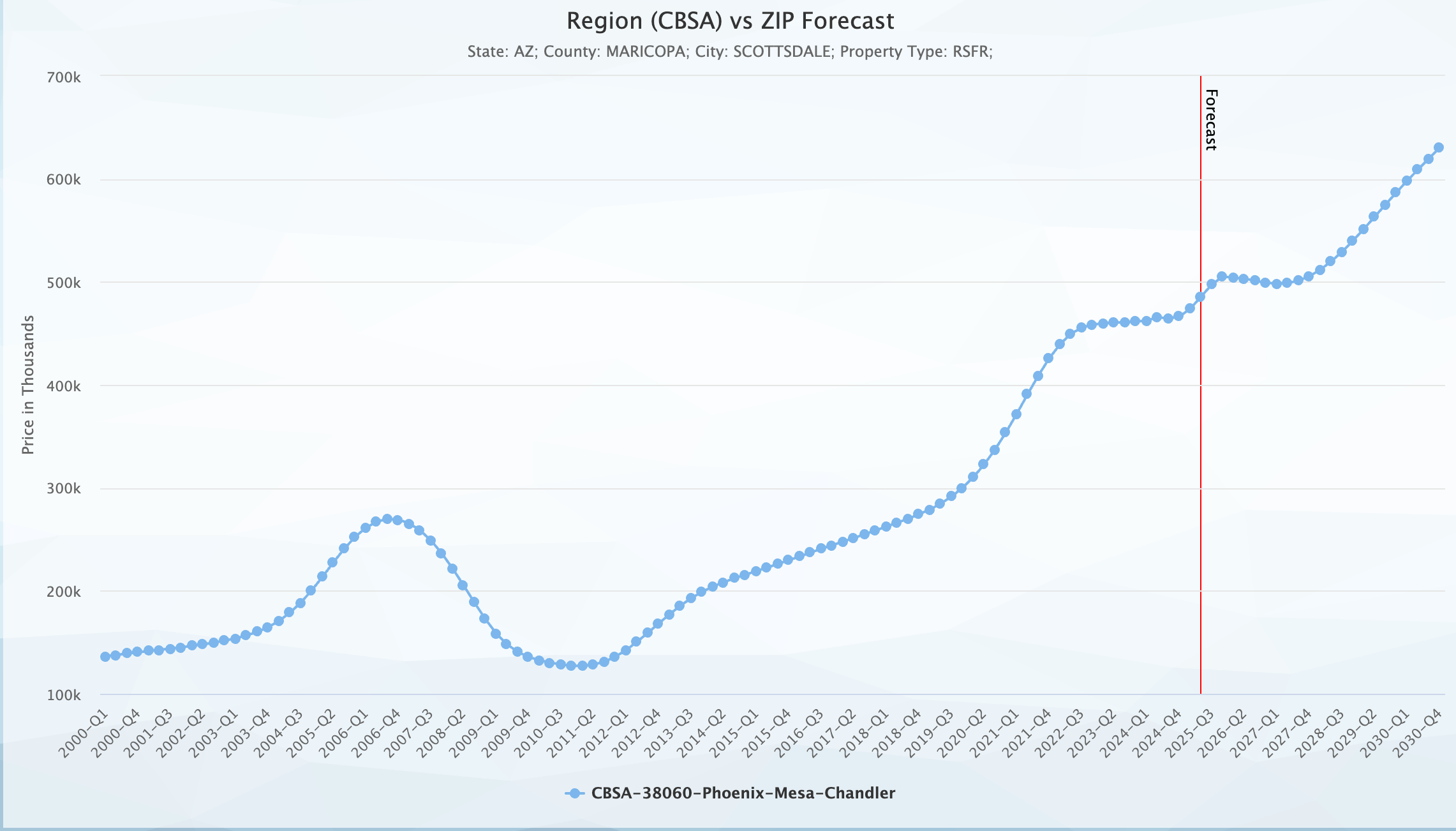

This regional trend line models projected pricing through 2030, incorporating economic and housing fundamentals for the greater Phoenix metro (Maricopa County, including Scottsdale).

Historical & Forecasted Pattern

2000–2008: Classic pre-crash surge peaking near $260K, followed by the 2009 correction.

2012–2021: Prolonged recovery, with sustained appreciation exceeding 300%.

2022–2025: Plateau and consolidation phase around $475K–$500K.

Forecast 2026–2030: Renewed acceleration, projecting values near $650K–$675K by decade’s end.

Interpretation

This long-term “bank-grade” projection indicates:

Stability through 2025, then measured appreciation resuming by mid-2026.

Resilient fundamentals (migration, job growth, and inventory constraints) continuing to support value growth.

Scottsdale, as a high-demand submarket, is likely to outperform the regional median trend, especially in luxury segments.